NBT #2: How Ignoring Emotions Can Cost You Big Time

Plus, the worst investment I ever made.

I recently finished watching the Netflix show, "A Man in Full," about a real estate mogul, Charlie Croker, whose debts are about to be called in. Charlie desperately needs his competitor, Herb Richman, to buy one of his properties. Herb acknowledges that he hates Charlie, and says something along the lines of:

"But I never let my emotions sway my business decisions."

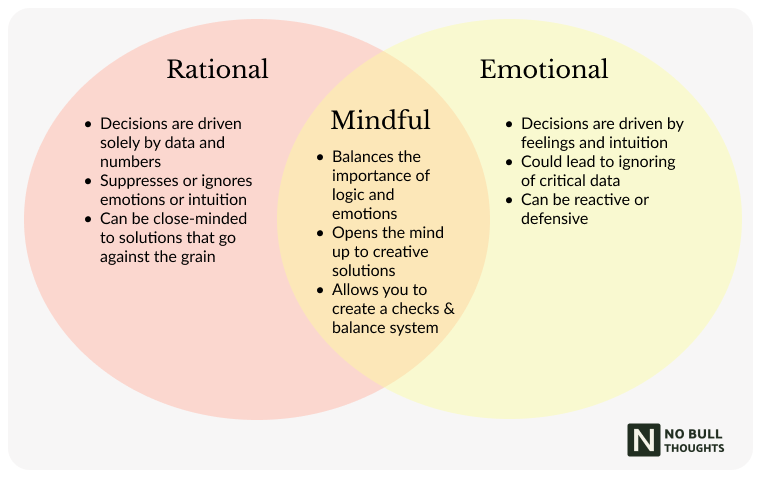

I find it a bit baffling that society, especially the business world, upholds completely emotionless decision-making as a virtue. After all, any strength taken to an extreme becomes a weakness.

Why is being extremely emotional viewed as a critical flaw while being extremely rational is upheld as a strength?

We don't need extremely rational business leaders. We need mindful business leaders.

Why Data Isn't Everything

The time Venmo almost didn't get invented

When Venmo was fundraising, a VC firm considering the opportunity apparently conducted a survey to ask people whether they wanted a social feed attached to their payments activity. The result? A resounding, unequivocal "no." People responded that the two concepts didn't mesh, that the idea was creepy, and that finances should be absolutely private.

Imagine if the co-founders of Venmo walked away dejected and gave up. Thankfully for me, they didn't. They moved forward with their quirky idea and did manage to get funding from investors who saw the value of doing something different.

At the time, there was zero data supporting the need or desire for a mobile, social P2P payments solution. If the founders had placed all importance on data, they never would have launched the app that became the impetus for the phrase "fintech."

The time I lost about $40,000

I invested about $100,000 with a CIO who prided himself on never being swayed by his emotions. He built his whole brand around the idea of being an emotionless investor who relied heavily on data, knowledge of history, and pattern recognition.

While he was extremely good at all of those things – analyzing data, recalling economic history, recognizing patterns – his inability to even recognize when he was experiencing an emotion ultimately meant that he had never created any checks and balances for himself as an investor.

Ultimately, my $100k investment with him ended up being my worst investment to date, with a loss of about 40%. Serves me right for believing an investor who stated he didn't have emotions. Like, don't we all know that Vulcans don't exist?! And even Vulcans recognize that they have emotions. C'mon, Esther. That one's on you.

People like me who are extremely emotional (and I say this with pride as someone who feels things intensely) generally learn how to recognize extreme emotions, and we learn how to moderate ourselves. We know when extreme emotions can be a strength (e.g., a fiery passion that compels me to produce the highest-quality work I possibly can) and when they can be a weakness (e.g., that time I b*tched out a product manager for showing up to a meeting unprepared and permanently soured my relationship with a critical partner).

We need leaders who have experienced the pros and cons of making overly rational decisions, as well as overly emotional decisions. Leaders who learn how to do the following will be at a huge advantage over purely data-driven leaders, especially now that data has become so easily accessible and understandable with AI:

Recognize and acknowledge their emotions

Recognize when data may not be everything

Build internal checks and balances

The time they forgot they were pitching to humans

As an angel investor, I've come across many pitch decks. I've also created many pitch decks for startups. However, I often notice a huge disconnect between the verbal and written pitches I receive.

Most entrepreneurs are able to convey a palpable passion for the problem they are solving when I meet them in person. But for some reason, that passion is absolutely nowhere to be found in their written pitch deck.

Instead, the written pitch deck is just pages filled with a mix of hypothetical and aspirational numbers. CAGR this, MAU that, hockey-stick growth...just like everyone else.

Numbers are great, but as a marketer and former consultant, I know that numbers can be leveraged to tell whatever narrative suits the business.

Conveying passion and excitement are just as important to investors, especially to angel and VC investors. Yes, investors want a return on their investment, but they also want to feel excited about the vision that they are fueling. If VCs were only about the numbers, they wouldn't be VC investors – they would be PE investors. Lol.

So What?

My takeaways are the following:

As a leader, tap into your own emotions as well as the emotions around you.

Hire people who can leverage both rational and emotional parts of their brains.

Create checks and balances for when you find yourself veering into either extreme.

Don't trust anyone who says they aren't swayed by emotions. It just means they're lacking in self-awareness.